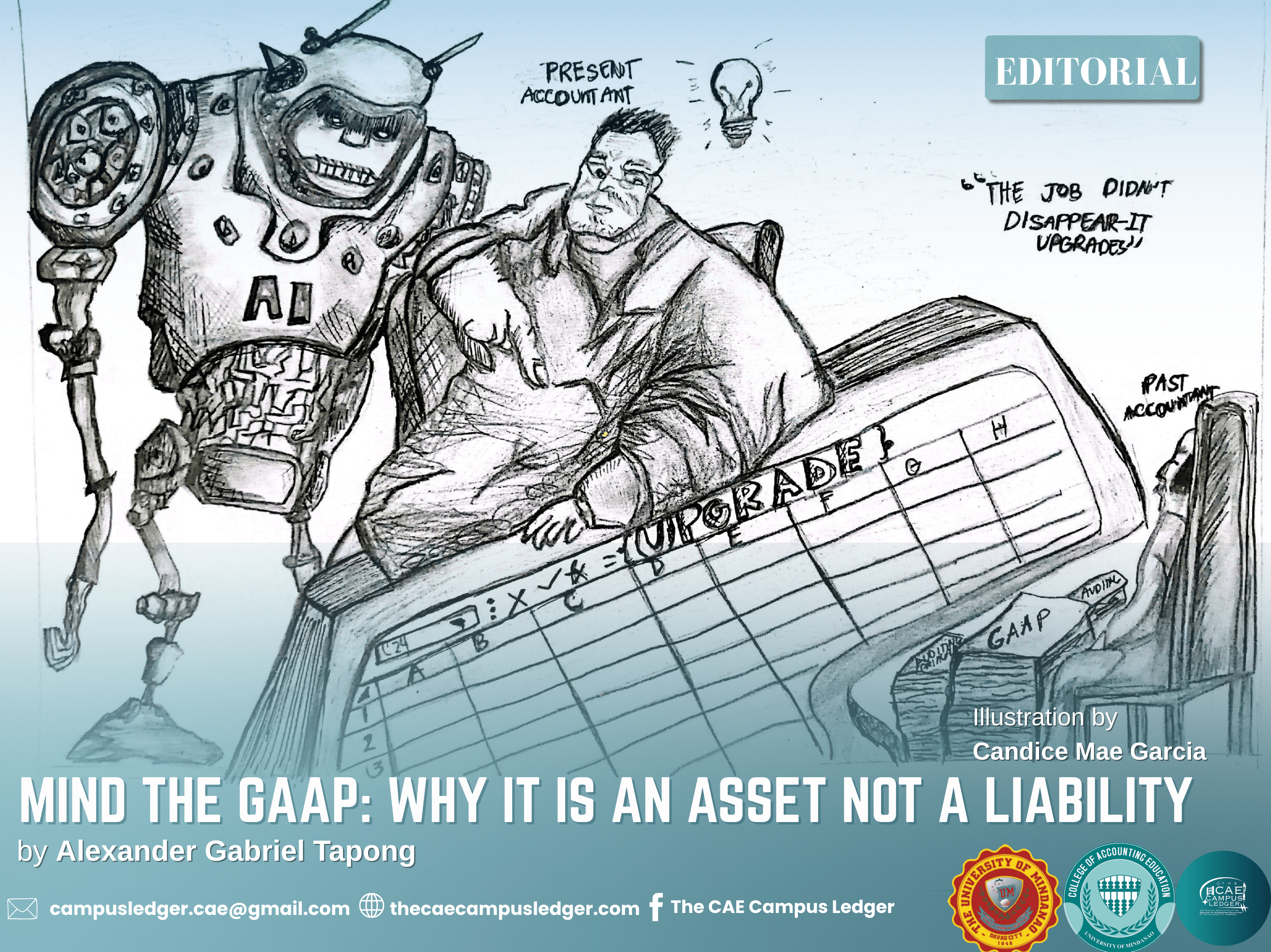

𝐄𝐃𝐈𝐓𝐎𝐑𝐈𝐀𝐋 l 𝗠𝗶𝗻𝗱 𝘁𝗵𝗲 𝗚𝗔𝗔𝗣: 𝗪𝗵𝘆 𝗔𝗜 𝗶𝘀 𝗮𝗻 𝗔𝘀𝘀𝗲𝘁, 𝗡𝗼𝘁 𝗮 𝗟𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝘆

"Will I be replaced?" is no longer a hypothetical question, it is a pressing economic concern. According to the International Monetary Fund (IMF) and the World Bank, over a third of the Philippine workforce—roughly 37% is at high risk of AI-driven displacement. For those in accounting and auditing, the warning is even louder. These roles are often categorized as having "low complementarity," meaning AI can perform their core tasks with minimal human intervention. Viewing AI as a rival ignores the real opportunity: it handles the messy data so that accountants can step up as trusted advisors who help shape a company's future. Research presented at the 2025 International Conference on Development of Digital Economy by Cheng et al. highlights a staggering efficiency gap, while a human takes an average of 15 minutes to process a single invoice, AI tools can complete the same task in just two minutes, while simultaneously slashing error rates from 5% to a mere 0.1%." That staggering efficiency gap is precisely what fuels the anxiety of displacement; when an algorithm can outperform a human fifteen times over without breaking a sweat, it becomes easy for professionals to fear that their specialized skills are being reduced to mere data processing that no longer requires a human pulse. While AI can outpace us in a race of data entry, efficiency is not a death sentence for the profession—it is an evolution. Far from being a threat, AI is becoming a vital ally in the fight against professional burnout. According to the 2025 Intuit QuickBooks Accountant Technology Report, 86% of accountants credit AI with reducing their mental load and preventing burnout. By accelerating the monthly closing process by an average of 7.5 days, AI isn't just increasing output for 81% of the workforce, it is giving them their time and mental clarity back. According to the Wolters Kluwer 2025 Future Ready Accountant Report, 93% of accountants are now using AI to transition into strategic advisory roles, leveraging the technology for real-time summaries and "what-if" scenarios. This shift aligns with a surging demand in the Asia Pacific region (APAC), where 69% of firms now prioritize advisory services, proving that AI isn't replacing the professional—it’s elevating them into an indispensable business partner. Evidence from the PwC Global AI Jobs Barometer 2025 confirms that the market values Human-AI collaboration over automation alone, with employers offering a 56% wage premium to professionals who master AI tools. This financial incentive is driven by a massive productivity gap, as AI-integrated roles are seeing nearly five times the growth of traditional positions. Ultimately, this data suggests that for those who adapt, AI is not a threat to their livelihood, but a catalyst for significantly higher earning potential and professional value. Additionally, data from LinkedIn’s 2025 Future of Work Report underscores this shift, noting a 75% surge in job postings that mandate "Generative AI" or "AI Literacy" for senior accounting positions. This trend proves that the 56% wage premium is no longer a mere performance bonus, but is rapidly becoming the new baseline for elite roles in the industry. As firms move from "considering" AI to requiring it, the ability to work alongside these tools has transformed from an optional edge into a fundamental requirement for professional relevance and high-tier earning potential. For Filipino accountants, AI literacy is no longer just a technical skill, it is a strategic edge in the global market. According to ACCA Philippines (2025), approximately 73% of the local accounting workforce is already "AI-ready," meaning they are actively seeking out solutions like JuanTax to automate local compliance. This digital hunger gives Filipino CPAs a unique advantage: they can combine their world-renowned "soft skills” such as empathy, effective communication, and ethical integrity with high-speed automation. By leveraging the Philippines’ $38 billion BPO industry, which is projected to grow by 7% in 2026, AI-literate accountants are moving from being "back-office support" to becoming high-value strategic partners for global firms. Ultimately, the question isn’t whether AI will take your seat, but who will be sitting in it. AI will not replace the accountant; however, the tech-savvy professional who masters these tools will inevitably outpace the one who refuses to adapt. Sources: https://economicgraph.linkedin.com/research/work-change-report?hl=en-US https://www.elibrary.imf.org/view/journals/001/2025/043/article-A000-en.xml?hl=en-US https://www.pwc.com/gx/en/issues/artificial-intelligence/job-barometer/2025/report.pdf?hl=en-US https://www.cpapracticeadvisor.com/2025/08/06/how-ai-and-automation-are-redefining-accounting-in-2025/166701/?hl=en-US https://www.wolterskluwer.com/en/news/wolters-kluwer-releases-its-2025-future-ready-accountant-report?hl=en-US https://www.shs-conferences.org/?hl=en-US https://www.vritimes.com/ph/articles/095e0a37-669e-4975-b67d-080e4601f026/c2d36bc1-7ecc-4834-bfca-36639ec8d00c?hl=en-US ✍️Alexander Gabriel Tapong 🎨Candice Mae Garcia